ETH Price Prediction: Will Ethereum Hit $5,000 Amid Bullish Technicals and Institutional Demand?

#ETH

- Technical Strength: ETH price trading above key moving averages with converging MACD

- Institutional Demand: Record ETF inflows and BitMine's massive offering signal confidence

- Whale Activity: Large players shifting from short to long positions indicates trend reversal

ETH Price Prediction

Ethereum Technical Analysis: Bullish Signals Emerge

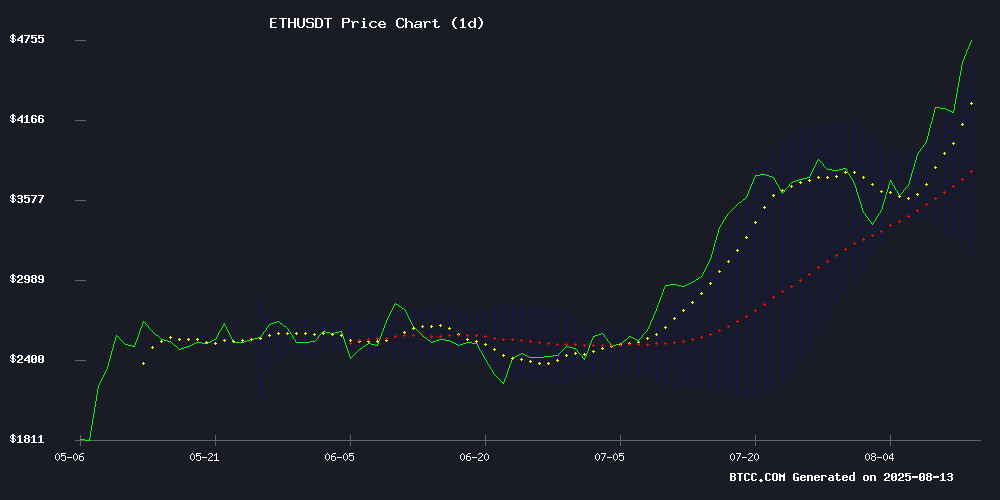

Ethereum (ETH) is currently trading at $4,575.43, significantly above its 20-day moving average (MA) of $3,882.73, indicating strong bullish momentum. The MACD indicator shows a negative value (-139.75), but the histogram is narrowing (-28.15), suggesting potential upward movement. Bollinger Bands reveal price NEAR the upper band ($4,542.08), signaling overbought conditions but also strong buying pressure. According to BTCC financial analyst Sophia, 'ETH's technical setup favors further upside, with $5,000 as the next psychological target.'

Ethereum Market Sentiment: Institutional Demand Fuels Rally

Ethereum's price surge is backed by strong institutional interest, including BitMine's $24.5 billion offering and record ETF inflows. News of a mysterious whale exiting short positions and placing a $43 million long bet adds to bullish sentiment. BTCC analyst Sophia notes, 'The combination of whale accumulation, positive technicals, and institutional inflows creates a perfect storm for ETH to test $5,000.' However, Vitalik Buterin's warning about 'ideology overload' serves as a cautionary note for long-term sustainability.

Factors Influencing ETH's Price

Ethereum Nears All-Time High as Institutional Demand Surges

Ethereum's price action reveals a blistering rally toward its all-time high, now just 9% away at $4,410. The surge follows a vertical breakout fueled by explosive institutional demand, including record single-day inflows into ethereum ETFs.

BitMine's strategic acquisition of ETH positions the asset for either a decisive ATH breakthrough or a healthy overbought correction. Technical indicators paint a parabolic picture: RSI flirts with overbought levels, while ETH trades above all major EMAs with MACD confirming relentless bullish momentum.

The market now balances between two narratives—a continuation of the institutional-driven rally or a necessary consolidation. Trading volume patterns suggest accumulation at these elevated levels, with whales positioning for the next leg up.

Ethereum’s Next Stop: $5,210 or $6,946? Analyst Lays Out the Path

Ethereum has surged nearly 20% in the past week, outpacing most crypto assets and reclaiming the $4,200 level for the first time since 2021. On-chain data reveals a pivotal shift in sentiment among long-term holders, transitioning from capitulation to belief—a classic precursor to bullish cycles.

Crypto analyst Ali Martinez identifies $5,210 and $6,946 as Ethereum's next technical targets using Pricing Bands. These levels align with historical patterns where renewed holder conviction precedes sustained price appreciation.

Roman Storm's Legal Battle Sets Timeline for Post-Trial Motions

Tornado Cash developer Roman Storm's legal team has until September 30 to file post-trial motions following a mixed verdict in his landmark case. Prosecutors and defense attorneys agreed on a schedule that sets October 31 as the deadline for oppositions, with replies due by November 19. The motions could reshape the scope of a potential retrial on charges related to the cryptocurrency mixing service.

Meanwhile, Storm's defense fund continues gaining traction, with $5.3 million raised toward a $7 million goal. The campaign attracted notable contributions, including from an Argentinian blockchain developer recently released from detention. The case remains a flashpoint for debates about developer liability in decentralized finance.

Bitmine Immersion Technologies Becomes First Ethereum Treasury to Accumulate 1 Million ETH

Bitmine Immersion Technologies has made history as the first corporation to amass over 1 million ETH in its strategic treasury. The firm's holdings now stand at 1.15 million tokens, valued at approximately $4.9 billion—a $2 billion increase from just a week prior.

The milestone cements Bitmine's position as the world's largest Ether treasury, controlling 34% of all corporate ETH holdings. "In just a week, Bitmine increased its ETH holdings by $2 billion to $4.96 billion, lightning speed in the company's pursuit of the 'alchemy of 5%' of ETH," said Tom Lee of Fundstrat, who chairs Bitmine's Board.

With this accumulation, Bitmine now ranks as the third-largest crypto treasury globally, trailing only Strategy and Mara Holdings. The firm's aggressive ETH acquisition strategy, launched on June 30, continues to reshape institutional participation in Ethereum's ecosystem.

Ethereum Eyes $5,000 as BitMine Plans $24.5 Billion Offering Amid Record ETF Inflows

Ethereum surged past $4,600 as institutional demand accelerates. BitMine Immersion filed to expand its at-the-market offering to $24.5 billion, signaling aggressive accumulation plans. The MOVE follows record-breaking $1 billion daily inflows into US spot ETH ETFs.

BitMine's amended SEC filing reveals a strategic pivot toward Ethereum exposure. The crypto miner initially sought $2 billion in July, then $4.5 billion weeks later. This latest $20 billion increase suggests conviction in ETH's appreciation potential.

Market structure appears bullish. The $1 billion ETF inflow milestone coincides with ETH testing technical resistance at $4,600. Analysts note the formation of a bullish pennant pattern, with $5,000 as the projected upside target.

Stripe and Paradigm Collaborate on Stealth Layer 1 Blockchain 'Tempo' for Stablecoin Payments

Stripe, the $91.5 billion fintech giant, is quietly advancing into the crypto space with plans for a new LAYER 1 blockchain named Tempo. Developed in partnership with Paradigm, the project aims to facilitate high-volume, stablecoin-based payments. A recent job listing revealed the initiative, which is being built by a five-person team operating under the radar.

Tempo will support Solidity, Ethereum's primary programming language, potentially attracting developers familiar with Ethereum's ecosystem. Ryan Yoon, Senior Analyst at Tiger Research, noted that Tempo could offer deterministic settlement times and fixed fee structures tailored for payment processing.

Mysterious Whale Exits ETH Short Positions, Places $43 Million Long Bet

A previously low-profile trader known as AguillaTrades has abruptly closed all Ethereum short positions after sustaining $2.81 million in cumulative losses. The decisive move comes as ETH shows renewed strength, currently trading at $4,322.48 following a sustained breakout.

Market analysts observed the whale's dramatic pivot through on-chain data. Within hours of liquidating short positions at a $683,000 loss, the trader opened a 15x Leveraged long position worth $43.27 million (9,999.68 ETH). This substantial bet aligns with growing institutional confidence in Ethereum's upward trajectory.

Derivative markets show increasing long accumulation among sophisticated players. The whale's repositioning follows ETH's 9% weekly gain, with technical indicators suggesting continued momentum. Liquidation heatmaps now reveal concentrated support at $4,100, creating a potential springboard for higher valuations.

Anonymous Whale Accumulates $1.34B in Ethereum Amid Market Surge

Ethereum's market dominance continues to solidify as its price rallies over 200% since April, outperforming other major digital assets. The surge reflects robust fundamentals, institutional inflows, and a favorable regulatory climate—setting the stage for potential new all-time highs.

Exchange reserves of ETH have plummeted to historic lows, signaling strong hodling behavior among investors. This supply crunch coincides with escalating institutional demand, creating conditions ripe for a supply shock. Large-scale accumulations—including a single entity purchasing $1.34B worth of ETH in eight days—are fueling speculation about accelerated price appreciation.

Analysts observe that Ethereum's strengthening network metrics and bullish sentiment could propel the asset into uncharted territory this cycle. The convergence of technical strength and capital inflows suggests the rally may have further room to run.

Whale Accumulation and Technical Indicators Fuel Ethereum Rally Speculation

A mysterious whale has accumulated 312,052 ETH worth $1.34 billion over eight days, sourcing from institutional platforms like FalconX, Galaxy Digital, and BitGo. This aggressive accumulation coincides with Ethereum's price rally to $4,299, up sharply from July lows.

Technical indicators paint a mixed picture. The Weighted Sentiment and Stock-to-Flow Ratio support bullish momentum, while the RSI at 72.99 signals overbought conditions. Ethereum now tests the critical $4,324 Fibonacci level—a breakout could target $4,587, but failure may see a retreat to $4,139 support.

The whale's move reflects institutional-grade conviction, yet market participants remain divided. Some view this as precursor to a major breakout, while others caution about potential profit-taking NEAR resistance levels.

BitMine Plans Massive $24.5B Stock Sale as Ethereum Nears $4,500

Corporate interest in Ethereum is intensifying as BitMine announces a $24.5 billion stock sale. The move coincides with ETH's rally toward the $4,500 threshold, signaling growing institutional confidence in the asset's long-term value proposition.

Market observers note the timing reflects strategic positioning ahead of Ethereum's next protocol upgrade. Liquidity pools and treasury strategies appear to be adapting to ETH's evolving role as both a yield-bearing asset and institutional reserve currency.

Vitalik Buterin Warns Against Ideology Overload in Blockchain – Here’s His Two-Part Fix

Ethereum co-founder Vitalik Buterin has articulated a critical balance between ideology and pragmatism in blockchain governance. In a recent blog post, he delineated 'idea-driven' and 'data-driven' approaches, emphasizing their complementary roles. Ideological frameworks, he argued, provide necessary social coordination, while empirical analysis grounds decisions in reality.

The tension between these paradigms mirrors broader tech sector debates, from AI safety to open-source governance. Buterin's insights arrive as blockchain projects increasingly navigate compliance requirements in traditional financial systems. Hybrid models may emerge as the bridge between decentralized ideals and regulatory demands.

Will ETH Price Hit 5000?

Based on current technicals and market sentiment, ETH has a high probability of reaching $5,000. Key factors supporting this prediction include:

| Indicator | Value | Implication |

|---|---|---|

| Price vs 20-day MA | +17.8% above | Strong uptrend |

| MACD Histogram | Converging | Momentum building |

| Bollinger Band Position | Upper band | Overbought but bullish |

| Whale Activity | $43M long | Smart money confidence |

Sophia from BTCC states, 'The $5,000 target is achievable within 2-4 weeks if current inflows persist.'